Blog

Card Payments 101

Mar 7, 2023

It has been 4 years since my first day in the VC world. For those who don’t know me, in my pre-VC life, I was a policeman and an entrepreneur (crazy combo right?!). During my first months as a VC, I stumbled upon the fintech space, and it was love at first sight! I was lucky enough to connect with the founders of Belvo, the now leading open finance API for LatAm, when it was almost in an ideation stage. From that moment, I was enchanted by terms like payments, open banking, embedded finance, and banking as a service.

Ever since we have witnessed a drastic change in the European payments ecosystem with numerous paytech startups emerging either as alternative payment methods or service providers trying to improve the quality of the existing services. This change has also taken place in other ecosystems we are close to, like MENA and LatAm. After numerous DDs in many different models addressing payments, I wanted to deep-dive and decrypt the payments space on a holistic basis starting from the card payments.

I must say, trying to understand every process in the payments flow, the positioning of each stakeholder, and every service they provide was hard. After reading the first 50 blog posts about the card payments scheme, with a lot of contradicting information, the main feeling was despair. Thankfully, with some valuable feedback from people that work for leading paytech companies, the book “The Anatomy of the Swipe” (thanks for suggesting Thibault!), and a lot of cleansing of the information from more than 100 pieces of content, here we are to shed some light on this maze.

Overview of a card payments system

First of all, there are various card schemes around the globe that work based more or less on the same logic (Visa, Mastercard, Amex, Discover, JCB, and others), but the most prevalent ones internationally are Visa, Mastercard, and Amex.

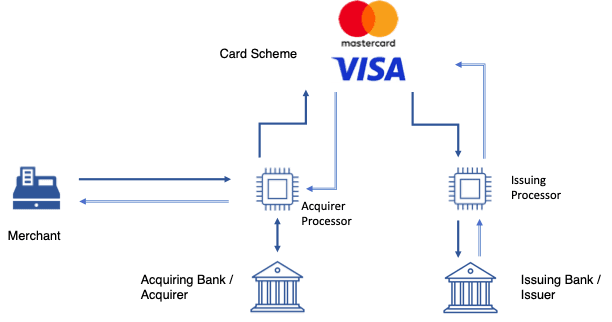

For a card transaction to take place, we need at least 3 key stakeholders (apart from the customer and the merchant), and a reliable secure internet connection for the needed information to flow through the system. The 3 fundamental stakeholders are:

the Issuing bank (Issuer): the bank that underwrites the user by giving them an account, a debit and/or a credit card

the Acquiring bank (Acquirer): the bank that holds the merchant account and provides the needed tools to the merchants to accept payments

the Card scheme (or card network, or payments network): it sets and manages the communication in-between the issuing and acquiring bank. In essence, it provides the rails for the transaction to take place.

Card schemes can be split into 2 categories based on how they operate. Amex belongs to the closed card networks, which means that it is also a bank, and it acts in parallel as an issuer and acquirer, while on the other hand, Visa and Mastercard belong to the open card networks, which act more like marketplaces and have relationships with multiple acquirers and issuers. In this post, we will focus on the major open card networks, Visa and Mastercard.

Both the Issuing and Acquiring banks need a tech layer to manage the flow of the information so that the transaction is processed. Some banks do have this tech layer in-house, but many don’t. For this reason, most of the times there are 2 more stakeholders in the card payments systems, the Acquirer processor and the Issuer processor.

TheAcquirer processor is the connecting link among the merchant, the acquirer, and the card scheme. Similarly, the Issuer processor is the link between the issuing bank and the card scheme. Both processors receive and transmit information to and from the card schemes and need to have a piece of hardware to connect directly with the card schemes.

Dual-Message Signature transaction is the most common type of card transaction, and it is called so because the transaction breaks into 2 messages, the Authorization (the first message), which happens at the time we use our card, and the Clearing (the second message) which occurs typically in bulk in the next 24-48 hours.

Single-Message transaction is called so because the authorization, clearing, and settlement of the funds take place instantaneously (with a single message). An example of a single-message transaction is the transaction at the ATMs when we withdraw cash from our bank accounts.

In this post, we will focus on the dual-message type of transactions in order to understand in a better way the flow of information and the internal processes.

Card transaction process

Authorization process

So, let’s start digging deeper into the Authorization process with a typical offline card transaction:

The customer wants to purchase a coffee from a cafe and swipes their credit or debit card through a POS (point-of-sale ) terminal (or a device that captures the customer’s card information).

The customer’s card information is transmitted from the POS to the Acquiring processor.

The Acquiring processor captures the transaction, determines which card scheme the specific card belongs to, and forwards the information to the relevant Card scheme (e.g. Visa, Mastercard).

The Card network, determines the issuer (based on the first 6 digits referred also as the BIN) and then routes the transaction to the Issuer processor, which in turn sends the information to the issuing bank (customer’s bank or issuer), and requests an approval. The transaction is approved or declined depending on the availability of the funds, and the status of the cardholder’s account.

The Issuing bank (customer’s bank) sends the response back to the issuer processor, which in turn sends the info to the card scheme network. If the authorization is approved, the issuing bank assigns and transmits an authorization code along with its response, and a hold is placed on the customer’s funds.

The Card network sends the approval to the acquirer processor, who in turn sends the approval to the cafe’s POS.

Clearing Process

Once the Authorization process has taken place and the customer has got their coffee, the amount of the transaction appears as a “Pending Transaction” in their bank account. Typically, by the end of the day, the cafe (merchant) either manually or automatically confirms the validity of the transactions (the clearing process). The Settlement is the actual movement of the money from the issuer (customer’s bank) to the acquirer (cafe’s bank) as instructed by the card scheme.

Revenue streams for each stakeholder

Card schemes

Visa and Mastercard in our example, collect money from the merchants and the issuers since they are positioned right in the middle of the payments system.

Fees charged to the Issuers by the Card networks:

A usage-type of fee every time a message passes through the card network. Thus, a dual message is charged twice.

Once the transactions are cleared, the card network charges the issuer a reporting settlement fee (most of the times a flat fee per transaction).

Various other SaaS-type of fees for services like settlement and/or fraud.

Fee charged to the Merchants by the Card networks via the Acquirers:

The network assessment fee is one of the fees that the merchant is charged and is netted out of the transaction value.

Issuers:

Fee charged to the Merchants by the Issuing banks via the Acquirers:

Interchange fees are a flat rate plus a percentage of the total sales and are determined by a large number of complex variables (card type, business size, industry, etc).

European Union caps the Interchange Fees with PSD2 where debit card interchange fees are capped at 0.2% and credit card interchange fees at 0.3% (excluding 3-party schemes and commercial cards that made back then 5% of the total card market in the EU countries) to help merchants and end consumers save some money. The results weren’t as positive as expected, and it is estimated that while PSD2 saved €2.7 billion from the interchange fees, the overall Merchant Service Charge (MSC) was reduced by just €1.2 billion for merchants. Due to acquirers interpreting the unbundling clause in a particular way, they had the opportunity to absorb a large portion of the interchange fee savings. In fact, acquirers saw revenues rise by over €1.2 billion following the regulation. Thus, the acquirer absorption rate reached 50% of the intended savings for merchants and consumers, while many member states and the European Commission do not police this regulation.

In the US market, there is a bipolar system, due to the Durbin Amendment (part of the Dodd-Frank law), where big banks (>$10Bn assets) cannot charge more than 21 cents and 0.05% on the total purchase value while smaller banks qualify for “Unregulated Interchange” and can charge higher. Many of the known neobanks and fintechs in the US (Chime, Revolut, etc.) partner with smaller banks, and this way a $0 fee banking can be somewhat sustainable.

Interchange fees are set by the card schemes, and they are not negotiable for the merchants. Depending on the number of service providers on the issuing side, the interchange fees are split and there could be also additional fees in-between the issuing bank and the service providers.

Acquirers:

There are various fees charged to the Merchants by the Acquirers, but below are the main ones:

The acquirer fee (or acquirer markup) is a flat fee typically charged at the end of the month by the Acquirer.

Additional fees could be in place also for services such as declined cards, chargebacks, etc.

Either a commission via a reseller agreement for the hardware (POS) or a margin off of it.

Depending on the number of service providers on the acquiring side, the fees are split based on the role of each provider. The acquiring fees are negotiable, and merchants can save significant costs if they take the time to review and understand their monthly statements.

Merchant's cost for accepting card payments

As we can understand, it is not easy for a merchant to end up with a clear picture of the total pricing for accepting card payments. The acquirers don’t have a consistent way when showing their pricing, which makes it difficult for merchants to decide which is the most economical choice for them. The final cost of the transaction depends on many factors, such as the acquirer, the region, the types of merchant, transaction, card, and many more.

There are 2 popular pricing models for card transactions when it comes to accepting Visa and MasterCard cards: Interchange++ and Blended.

Interchange++ is more transparent compared with Blended. It shows you a detailed breakdown of the 3 main payment card costs mentioned above: the card scheme fee, the interchange fee, and the acquirer markup. As the fees vary depending on many factors, they can sometimes be lower than a fixed rate or higher.

Blended charges an average processing cost plus a fixed markup. The merchant is charged the same markup for every transaction, and they can't see the split of the costs.

According to Adyen, a leading paytech startup in Europe and beyond, an indicative cost of accepting payments with Blended pricing model is 2.5% of the total transaction value whereas with Interchange++ it varies.

Chargeback

As defined in a report from the EU Commission, a chargeback is a technical term used by international card schemes to name the refunding process for a transaction carried out by card following the violation of a rule. Originally chargeback was a system developed by card issuers to protect consumers in case of fraudulent authorization of their card (e.g. following a theft or card cloning).

In essence, when cardholders don’t recognise a charge in their account, they can request their money back through their bank (issuing bank). Additionally, chargebacks include also the cases when the purchased product or service was never received, or it was of lower quality than expected, and the merchant refuses to return the money. Most of the times that customers initiate the chargeback process, their cards are canceled and their banks (issuing banks) issue new ones.

The liability rules and the actual process depend on many factors (region, type of transaction, etc.), but typically the chargeback is paid by the merchant or the card issuer. The card issuer will decide (partly or solely, depending on the regulation) how much liability will fall on the cardholder. The card networks don’t pay for the chargebacks.

The existing regulation protects the card user, especially against fraudulent transactions, but again depends on some factors and the relevant country. The card networks reinforce this because they want the cardholders to feel safe using their cards for their purchases. Thus, all the major card issuers have introduced zero-liability policies assuring the cardholders that any fraudulent charges that are reported or that the card issuer detects will be removed from the account, and the cardholder will not have to pay for them. These policies have some exceptions that are outlined in the cardholder’s agreement.

Merchants need to keep the chargeback rate lower than 1% because otherwise, they risk losing their ability to accept card-based payments through their acquirer. Thus, they are incentivized to use safer payment ways (e.g paying with the EMV chip in offline transactions). This is a result of the stringent rules that have been placed by the card schemes on the acquirers.

What is next

You probably noticed that I am using words such as “typically”, “most of the times”, etc. It’s because of the very nature of the payments and their complexity since there are many dependencies and factors that affect each process.

The above-described processes represent more of a simple offline transaction, but the differences with online transactions are minimal. The truth is that most of the times, both for offline and online transactions, there are many more service providers in the broader payments ecosystem, both on the acquiring and the issuing side, which I will analyse separately in upcoming blog posts. Once the card payments ecosystem and the size of the market are fully analyzed, I will deep-dive into the alternative payment methods which have been growing fast in the last few years.

Disclaimer: This post is not generated by ChatGPT or any other form of artificial intelligence. 🙂